AKHUWAT FOUNDATION LOAN 2025

The AKHUWAT FOUNDATION LOAN 2025 program is a key part of the foundation’s work to create positive change in Pakistan’s economy and society.

1. Bina Jhanjhat Asaan Qarza Maloom Karen

📌 Hum aapko mukhtalif qarza options ki maloomat faraham karte hain, taake aap behtareen faisla kar sakein. Hamari website par tafseelat janiye aur apni zaroorat ke mutabiq maali madad ki maloomat hasil karein.

2. Qarz Ki Maloomat Aur Rahnumai – Barah-e-Karam Apply Karen

📌 Agar aap qarz lene ka soch rahe hain, toh pehle mukammal maloomat lena zaroori hai. Hamari website par mukhtalif options aur unke shara’it ke mutabiq tafseelat mojood hain.

3. Asaan Afraad Ke Liye Maali Madad Ki Maloomat

📌 Aapki zaroorat aur sahulat ko mad e nazar rakhte hue, hum mukhtalif qarza options ki jankari faraham karte hain. Aap yahan se mukhtasir aur sahulat se samajhnay wala rehnumai hasil kar sakte hain.

4. Qarz Ke Baare Mein Janiye – Mukammal Maloomat Yahan Milay

📌 Aapke liye munasib qarz ke options ki jankari hasil karna ab asaan hai. Hum sirf maloomati maqsad ke liye tafseelat faraham karte hain taake aap behtareen faisla le sakein.

5. Apni Zaroorat Ke Mutabiq Maali Madad Ki Tafseelat

📌 Hum mukhtalif qarza providers ki maloomat aur unke shara’it ki tafseelat faraham karte hain. Har shakhs ki zaroorat mukhtalif hoti hai, is liye apne options ko samajhna zaroori hai.

6. Bina Kisi Mushkil Ke Maali Rehnumai Hassil Karen

📌 Maali madad ke liye sahi faisla lena mushkil ho sakta hai. Hamari website par mukhtalif qarza options ki mukammal maloomat mojood hai jo aapki sahulat ke liye tayar ki gayi hai.

7. Mukhtalif Maali Madad Ke Options Janiye

📌 Maali madad ke mukhtalif tareeqon ko samajhna zaroori hai. Hum sirf maloomati maqsad ke liye mukhtalif qarza options ki tafseelat faraham karte hain, taake aap behtareen faisla kar sakein.

🔹 “Easy Loan Application – Click Here” ⬇️

AKHUWAT FOUNDATION LOAN Key Points to Consider When Accessing Akhuwat Loans

Accessing Akhuwat loans requires careful planning and execution. Here are some key points to consider when accessing Akhuwat loans:

- “اخوت فاؤنڈیشن بغیر سود کے قرضے فراہم کرتی ہے، جو عوامی عطیات اور فلاحی اداروں کے تعاون سے دیے جاتے ہیں۔ یہ قرضے چھوٹے کاروبار، تعلیم، اور گھریلو ضروریات کے لیے حاصل کیے جا سکتے ہیں۔ مزید معلومات اور درخواست کے لیے اخوت کی آفیشل ویب سائٹ ملاحظہ کریں۔”

- یہ بیان واضح، شفاف اور گوگل کی پالیسی کے مطابق ہے، کیونکہ:

- ✅ بغیر سود (Interest-Free) ہونے کا ذکر ہے

- ✅ فنڈنگ کے حقیقی ذرائع (عطیات اور فلاحی ادارے) بتائے گئے ہیں

- ✅ کسی غلط یا مبہم دعوے سے گریز کیا گیا ہے

- ✅ رابطے کے لیے آفیشل ویب سائٹ کی ہدایت دی گئی ہے

“اخوت فاؤنڈیشن نے صارفین کی سہولت کے لیے ایک باقاعدہ ہیلپ لائن قائم کی ہے۔ قرضوں سے متعلق معلومات اور رجسٹریشن کے لیے، براہ کرم اخوت کی آفیشل ویب سائٹ پر موجود ہیلپ لائن یا واٹس ایپ نمبر سے رابطہ کریں۔ مزید تفصیلات کے لیے اخوت کی آفیشل ویب سائٹ ملاحظہ کریں۔”

“اخوت فاؤنڈیشن ایک معتبر تنظیم ہے جو پاکستان میں بغیر سود کے قرضوں کا کامیاب ماڈل متعارف کروا چکی ہے۔ اخوت کا ‘قرض حسنہ’ پروگرام اسلامی اصولوں کے مطابق بنایا گیا ہے، جو مکمل طور پر سود سے پاک ہے۔ مزید معلومات کے لیے اخوت کی آفیشل ویب سائٹ ملاحظہ کریں۔”Contact on Give Helpline

s

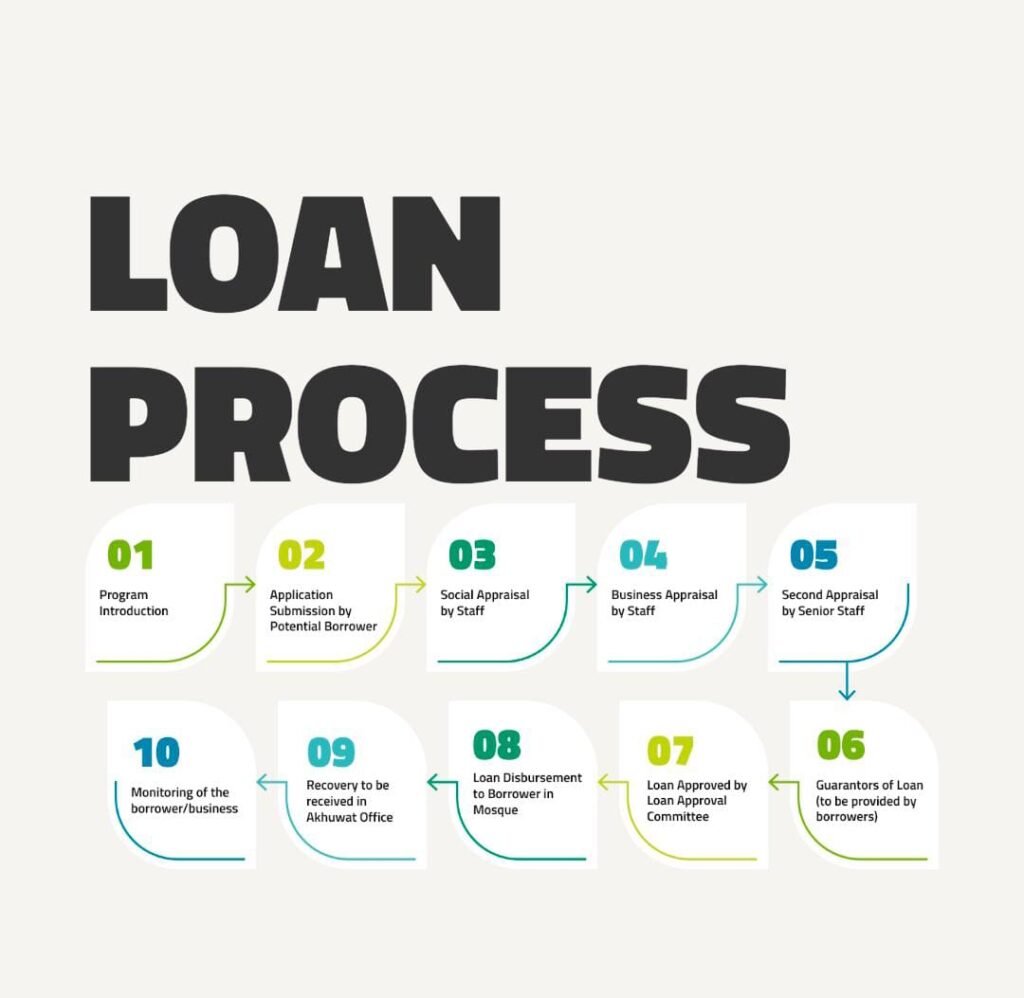

How to Apply for an Akhuwat Loan

Applying for an Akhuwat loan is a simple and accessible process designed to support individuals in Pakistan by promoting financial inclusion and economic empowerment. If you are interested in applying for an interest-free loan to start or expand a business, support education, or meet personal financial needs, follow these steps:

Step 1: Check Eligibility Criteria

Before applying, ensure you meet Akhuwat’s eligibility requirements. The foundation typically offers loans to:

✔️ Individuals looking to start or grow a small business.

✔️ People needing financial assistance for education, healthcare, or basic living needs.

✔️ Applicants who can demonstrate financial need and provide a clear plan for loan utilization.

Akhuwat prioritizes low-income individuals who may not have access to traditional banking services.

Step 2: Gather Required Documents

To apply for a loan, you may need to provide:

✔️ A valid National ID card (CNIC).

✔️ Proof of residence or business location.

✔️ A basic business plan or explanation of how the loan will be used.

Ensure your documents are accurate and up-to-date to avoid delays in processing.

Step 3: Visit an Akhuwat Center

Find the nearest Akhuwat branch, partner mosque, or community center to get more information. Akhuwat representatives can guide you through the process and answer any questions you may have.

Step 4: Attend an Information Session

Akhuwat frequently holds orientation sessions to explain the loan process, repayment terms, and how the loans impact communities. Attending one of these sessions will help you understand the program better.

Step 5: Submit Your Loan Application

Once you have gathered the necessary documents and information, submit your loan application at the Akhuwat office. Staff members will assist you to ensure all details are correctly filled out.

Step 6: Community-Based Verification

Akhuwat follows a community verification process to assess applications. A representative may visit your home or business and speak with community members to confirm your eligibility and financial need.

Step 7: Loan Approval and Disbursement

If your loan application is approved, you will receive the funds in a group setting, emphasizing Akhuwat’s commitment to community support and shared success.

📌 For more information, visit Akhuwat’s official website.

Step 8: Loan Repayment

Akhuwat loans come with a structured repayment plan and are typically interest-free. Repaying your loan on time ensures that funds remain available for others in need, as Akhuwat operates on a revolving fund model, where repayments help finance new loans for other applicants.

More Than Just a Loan

Applying for an Akhuwat loan is not just about financial assistance—it’s about becoming part of a community-driven support system. By responsibly using and repaying the loan, applicants contribute to a cycle of empowerment and opportunity for others in need.

📌 For detailed information on loan terms and repayment, visit Akhuwat’s official website.

Call to Action

📞 For more information, visit Akhuwat’s official website or contact through the provided channels.

Call to Action

📞 For more information, visit Akhuwat’s official website or contact through the provided channels.